Sentiment sours as the S&P 500 tests key support

We had a reprieve in the selling yesterday, but US equities are finding sellers easy to come by. Not only has the S&P 500 closed -0.6% and close to the lows of the day, but we see price challenging the key 50-day MA and lower Bollinger Band - both have defined the buy-the-dip level of the market since October 2020, so it’s ‘make or break’ time. The market is at risk of talking itself into a pullback of 5%+.

Sentiment seems to have soured somewhat – but is this flow related ahead of OPEX, or has the news flow warranted the moves? I’d argue the former.

Predictably, the VIX index has pushed back towards 20% and the VIXY ETF is one of the best performers in our universe of ETFs. Small caps have underperformed, with the Russell 2k -1.4%, and while we see the S&P500 -0.6%, 75% of stocks closed lower and volumes were 9% above the 30-day average. Cyclical and value plays were shunned, with energy, financials and industrials leading the market lower.

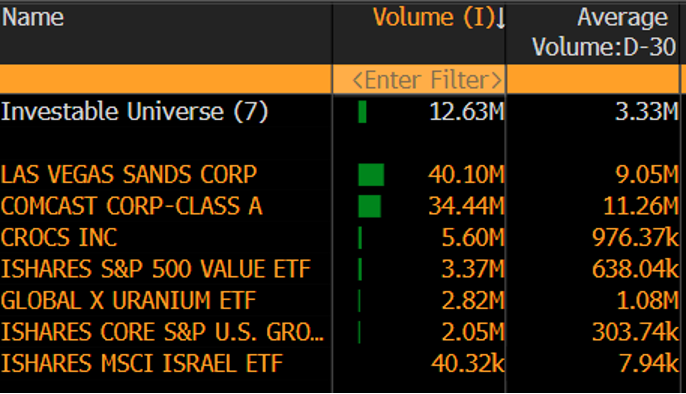

Scanning the market for the big volumes plays of the day, where they say ‘size opens eyes’, we see the following names 2.5x 30-day average.

Big volume plays

(Source: Bloomberg - Past performance is not indicative of future performance.)

Take a look at Crocks (on MT5), one of the names on the scan – not only did they rally 9% on a huge sales guidance upgrade, but the trend looks absolutely breathtaking. Never been much of a fan of Crocs but someone is buying their products; a lot of them. That said, what I like and what the market likes can often be two very different things, and I’d imagine shareholders will be saying “is this a $200 stock?”

The gap between CPI and PPI grows wider

US CPI missed estimates on core CPI, with a year-on-year pace of 4% vs 4.2% eyed. There has been a solid bid in US Treasuries, with 10s -5bp to 1.27%, while 30yr Treasuries have broken the rising trend support and this suggests yields may be headed lower (price higher) – clients can trade this with the TLT ETF (on MT5). Lower bond yields have helped the NAS100 to outperform (closing -0.3%), with Apple (closed -1%) failing to set the market alight with its Annual Event.

The idea of widening differential between PPI and CPI is not a risk positive… if we’re looking for a fundamental reason for equity weakness, I’d argue this is one of them, where this is key for those who watch margins.

We’ve seen some buying in gold on the bullish bond dynamic – gold likes lower bond yields – with spot gold trading to 1808 and printing a bullish engulfing candle – follow-through buying in the session ahead and 1820 would be a near-term target, while through the week upside should be capped into $1828 – levels where I’d be keen to look at shorts. Looking at client exposure, it’s fairly balanced, with 59% of all open positions held short.

Elsewhere in commodity land, copper closed -1.4% and that offers insight in economics that we may not be getting in other industrial metals. Keep an eye out for China’s high frequency data dump today at 12:00 aest – retail sales (consensus eyed at 7%), industrial production (5.8%) and fixed asset investment (9%) – we’d need a decent miss in industrial production to cause a huge spike in volatility but given the slight risk-off tone perhaps this would provide a tailwind. Good numbers seem likely though – China has a tendency of producing better numbers when the tone is souring – watch copper rand the AUD, as well as the CN50 index.

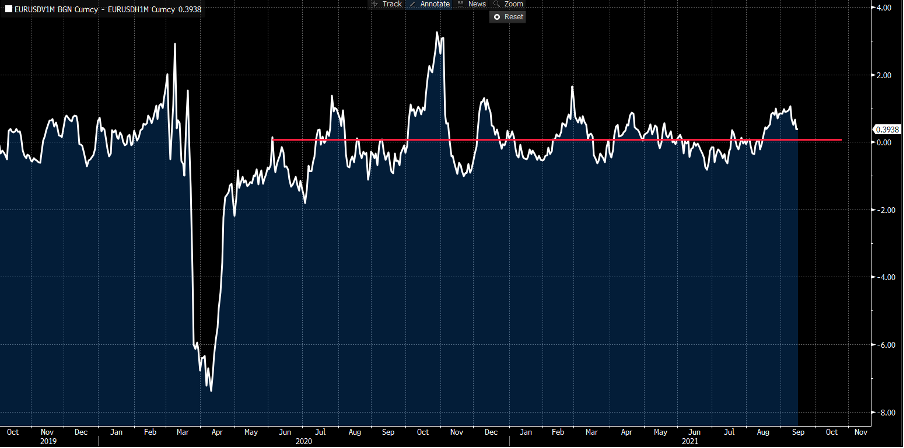

EURUSD 1-month implied volatility minus 1-month realised vol

(Source: Bloomberg - Past performance is not indicative of future performance.)

The USDX is flat on the day, but this has been driven by a limited percentage change in EURUSD – EURUSD rallied to 1.1846 on the US CPI print, only to test the 1.1800 handle. Still, a 46-pip range is hardly much to get too excited about and really very little for traders to sink their teeth into. However, when you have EURUSD 10-day realised volatility at 2.64% and eyeing multi-year lows, it’s not surprising. In fact, when I look at the spread between 1-month implied volatility and 1-month realised it’s now pulling back. Perhaps a function that US CPI has been weaker and reducing the need for the Fed to normalise.

The risk off vibe has been felt in the ZAR and AUD

The risk-off feel has been more cleanly express in higher beta FX, we’ve seen selling in the ZAR and AUD – AUDUSD has been well traded by clients, although the split of long/short open positions is perfectly balanced. There may have been some reaction to RBA gov Lowe’s comments yesterday, but the pair has broken lower and now sits on the former range lows. The 50% retracement of the Aug/Sept rally comes in at 0.7315 and it feels like this may be challenged sooner – let’s see China’s data dump today, and see if there is a reaction here – locally, the Westpac Consumer confidence print, I strongly suspect, won’t move the dial too intently today – sentiment across markets seems to be the play for the AUD and if copper and iron ore futures can pull lower, and Chinese equities too, then I suspect AUD will follow.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. cryptoburst doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of cryptoburst, reproduction or redistribution of this information isn’t permitted.