The Macro Trader - understanding the risk from the German election

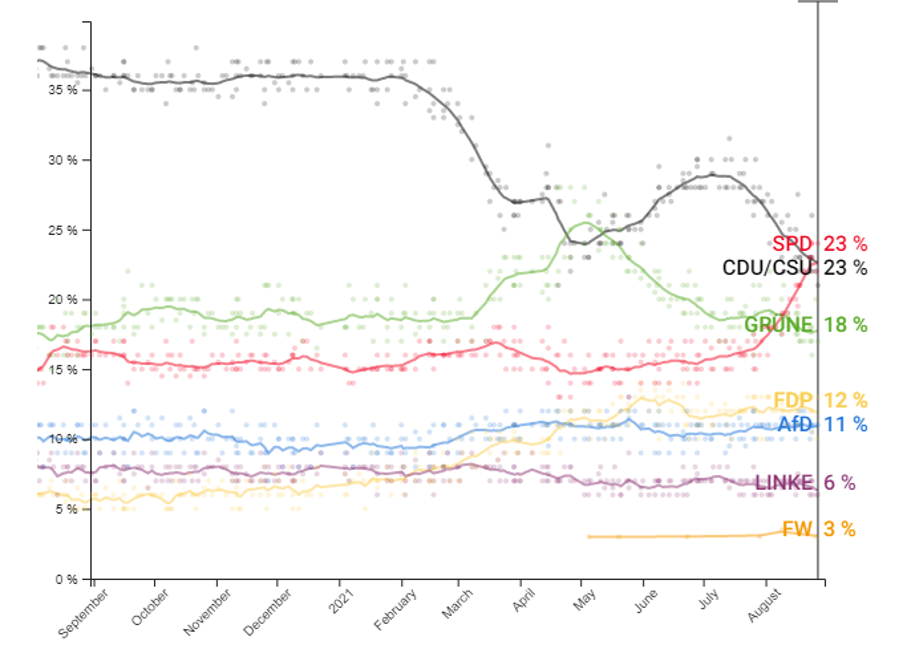

With just under four weeks to go, the countdown is on and at the time of writing we’ve just seen the first public TV debate. An event that many felt was won by SPD candidate Olof Scholz, with the Greens coming in second. The next two TV debates play out on 12 and 19 September. The polls are certainly getting more of a focus now, and we’ve seen the SPD party making a move in the last few weeks, so one questions if Olaf Scholz’s performance and his increasing popularity can propel the party higher.

(Source: Politico EU)

The election playbook for markets is genuinely messy and anyone not following the situation closely would have to do a bit of research to understand each party’s manifesto. With no one party likely getting majority, alliances and strategic tie-ups will likely have to be formed, which means we may well see two and potentially three parties forming a minority government.

Potential outcomes in the election - The potential combination of parties means we are likely going to see a centrist government emerge – the question will be whether it is centre-left or right-leaning?

Centrist government – (CDU/CSU, Greens, FDP), (CDU/CSU, Greens), (SPD, Greens, FDP), or a Grand coalition between CDU/CSU and SPD (possibly with FDP.

Centre-left government – a combination of (SPD/Greens), (SPD, Greens, FDP), or (SPD, Greens, Linke).

Centre-right government – (CDU/CSU, FDP) or (CDU/CSU, SDP, FDP)

The question then becomes how long it takes to forge a government. It may be weeks before we know a result. While the market will speculate, it's hard to price market risk with such uncertainty at a fiscal level.

The simplistic election playbook

At a simplistic level, the market has a belief that the more left leaning the government the more expansive the future fiscal policy setting will be. The further right of centre the more restrictive on policy and more in-line with the decade-old policy of running prudent budget surpluses, with debt-to-GDP well below the average of its European partners.

On spending, the CDU party for example remain steadfast in its belief of returning to a balanced budget, while the FDP party want to reduce debt c.10ppt as soon as possible.

The SPD Party and the Greens are looking for expansive levels on spending. However, they would look more intently at taxation, notably on the rich.

Spending and taxation aside, there's other focal points investors should consider such as social policy, housing, foreign policy, and Germany’s relationship with the broader European Union.

The more we see Germany move to a less fiscally prudent world the greater the implications on government bond issuance, which is also a consideration for the ECB and its asset purchases. In theory, the more left-leaning the make-up of the government, the greater the probability we see a sell-off in bunds, with yields moving higher (less negative).

While the ECB will likely buy greater levels of German debt (as part of the asset purchase program), one could argue this will also prove to be a EUR positive as it incentivises foreign investment capital into the country.

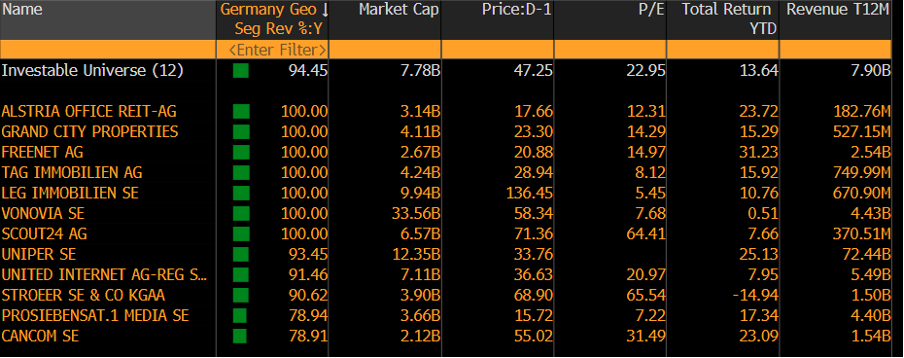

The DAX should outperform, and long DAX/short EU Stoxx 50 may work well as a relative pairs trade. However, with close to 75% of the companies within the DAX index sourcing sales from abroad, the benefit of looser fiscal policy on the full suite of German corporates is limited. We can drill down to single stocks that source revenue from the local economy and here I have scanned our universe of German stocks for those who make over 75% of sales in Germany. These should work well in a less austere government.

We can see these corporate have largely outperformed the DAX index.

(Source: Bloomberg)

Of course, the opposite is also true and the more conservative the government the more these names may underperform – in this scenario, we may see better buying in German bunds, and a weaker EUR.

For context, EURUSD 1-month implied volatility is 5.48%, standing at the 17th percentile of the 12-month range. It hardly screams of a market anticipating volatility and the market prices (with a 68.2% level of confidence) that EURUSD will be confined to a range of 1.1994 to 1.1630 through this period. Incredibly, that also includes the 23 September FOMC meeting.

30-day implied volatility in the German DAX (i.e. the DAX VIX index) sits at 17.26%, not far off 52-week lows – while this is in fitting with implied vol in other global equity markets, traders are not worried about imminent volatility in German equities into the election – That may well change and we may see greater hedging activity play out, although whether that’s driven by domestic political news or from global macro issues remains to be seen.

However, when it comes to political risk traders want clear evidence of what the government looks like and fast - so we can price risk and react to certainty – however, in this election the prospect of immediate certainty seems low. Still, with Angela Merkel leaving her position as Chancellor after 16 years, and the potential to increase the tolerance for deficits and higher levels of spending, it promises to be a symbolic election and one that could hold longer-term implications for Europe more broadly.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients. cryptoburst doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of cryptoburst, reproduction or redistribution of this information isn’t permitted.